by Paul John Lythgoe

access_timePosted 1st November 2024

October 30th 2024 budget was a momentous occasion as it was the first ever to be delivered by a female chancellor, and the first in 14 years by a labour party chancellor.

Considering that the labour party defines itself as a party of growth and employment, it is without doubt that Rachel Reeves budget is expected to be extremely damaging to the UK manufacturing industry.

The reasons for this gloomy outlook are:

An increase in the national Minimum Wage of 6.7% for employees aged over 21 years and 16.3% for ages 18 to 21 years (the largest such increase on record), along with apprenticeship levy and other policies over recent years, risk damaging manufacturers’ investment in their workforce.

Although these rises apply to the minimum wage, it is natural that other employees will expect similar wage increases to maintain differentials.

These costs cumulatively send employers’ costs to new heights.

National Insurance contributions paid by employers will rise from 13.8% to 15%.

This does not at first glance appear to be a large increase, but In addition, the start point (the threshold) at which businesses pay National Insurance on their employees earnings will be lowered from £9,100 to £5,000.

This calculates out at an extra £806 that employers pay to the Government for each employee on minimum wage, more for those on higher wage.

The chancellor has done nothing to help with the cost of energy and standing charges which are increasing once again.

Where investment is being made in manufacturing sectors, these are only in electric vehicles, aerospace, life sciences and clean energy. These ‘strategic’ sectors (many owned by overseas investors) will benefit from £4.5 Billion funding.

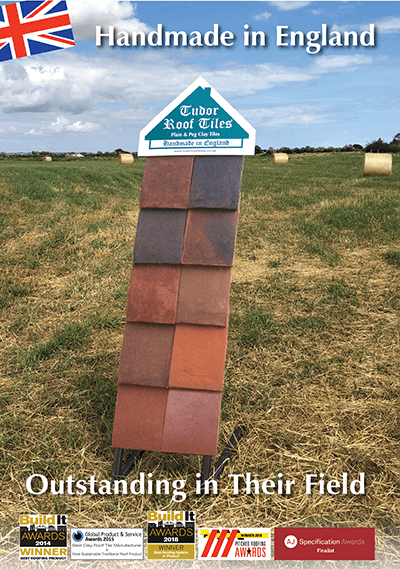

English owned medium sized manufacturers such as Tudor Roof Tiles (50 employees) will get nothing.

The Government’s Industrial Strategy commits to continued support for ‘Made Smarter’ which helps smaller manufacturing businesses boost productivity by introducing digital technologies.

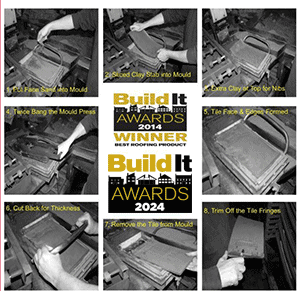

With handmade products and people skills, this digital improvement can only be made by removing the people and replacing them with machine made technology. This is not an option for Tudor Roof Tiles!

The Confederation of British Industry (CBI) has reacted to the budget by stating that ‘this is a tough budget for businesses’.

They also say that employer cost base increases will increase the burden on business, limiting ability to invest.

Like many similar sized employers will look at ways to mitigate these costs and their affect on customers and employees alike.

We believe that handmade roof tiles are essential to British heritage buildings and we are proud to be a part of this conservation.

We also have proudly shown that our tiles can be used with great visual impact on modern buildings, and we look forward to many future projects.